Bad Credit Business Loans and Other Ways First Capital Business Finance Can Help Your Business During COVID-19

If you need bad credit business loans or other financings to help you recover from a temporary closure, supply problem, business slowdown, or other issues caused by the COVID-19 pandemic, First Capital Business Finance is here to help. We will help your business get through this difficult time and come out stronger on the other side. If your […]

How Bad Credit Business Loans Can Help You Grow Your Business

Bad credit business loans can help you get the cash you need to grow your business. If you have poor or limited credit, or have been in business for less than two years, our financing options can help your business in a variety of ways. Maintain Control of Your Business If your business needs more cash, you may […]

Bad Credit Business Loans: One of Four Main Solutions Business Owners Now Turn To

More business owners across America are considering bad credit business loans as they face unprecedented financial and logistics struggles. These struggles followed state orders that shut down non-essential businesses to keep more people at home. To maintain some income, many business owners were forced to get creative, seek out disaster relief, or both. Where government assistance […]

Keep Your Company Afloat During Quarantine With Bad Credit Business Loans and Other Resources

Bad credit business loans are an important resource for any struggling enterprise, but they’re especially valuable during these unprecedented times. With the pandemic threatening lives and livelihoods, we as an economy have had to shift our business structures to adjust. As the illness continues to threaten the country, here are a few ways to keep your company running. […]

5 Ways to Preserve Capital During Slow Times

During slow times, many businesses focus on preserving capital rather than taking out bad credit business loans (although loans can still be a smart option). However, the emphasis is usually on asking for rent relief and putting a hold on vehicle insurance. Here’s a look at these two approaches and three other ways to save money. 1. […]

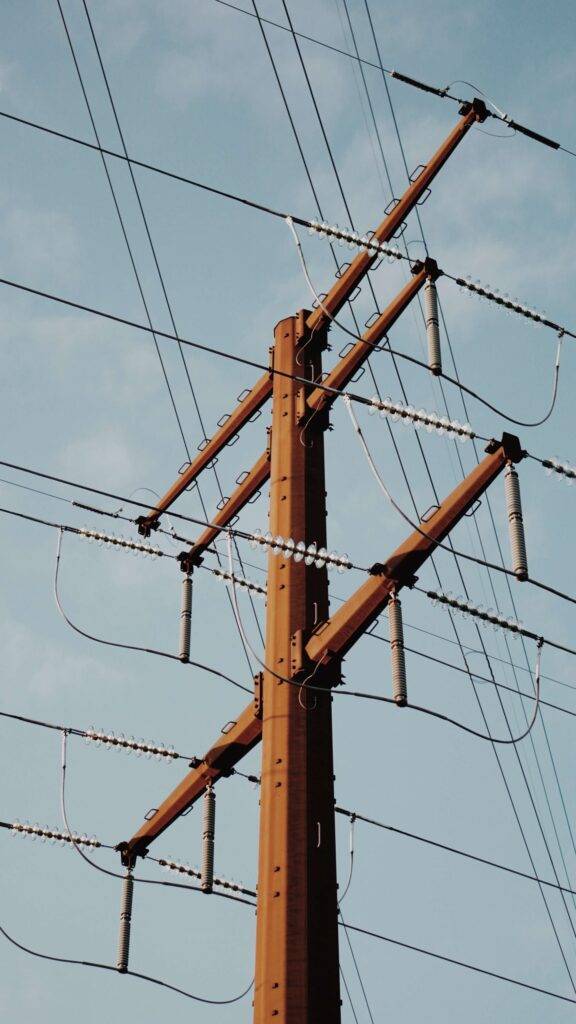

The 6 Top Construction Equipment Loans for Bad Credit 2020

A construction equipment loan is a great way to obtain the capital you need to purchase the equipment for your business. However, if your credit is that great, you may fear that a loan is out of your reach. Fortunately, some lenders recognize unforeseen circumstances that can blemish the credit of even the most promising […]

We are Still Here to Help (COVID-19)

Amidst the current uncertainty surrounding COVID-19, we want to assure you that First Capital Business Finance is doing everything possible to help reduce the spread of the coronavirus. The well-being of our customers, our staff, and community is our top priority and we are taking every precaution to keep them safe. I wanted to take […]

The Importance of Working Capital for Construction Companies

Access to working capital plays an indispensable role in a business’s survival and growth. To ensure there is always cash in hand, proactive companies use elaborate cash flow forecasts to determine what they need money for and when. Some also rely on relationships with a construction equipment loan provider to spread out the initial cost […]

How To Keep Your Small Business Healthy After an Unexpected Disaster

As a small business owner, your company, employees and customers are more than numbers on a sheet. They’re important to you. That’s why you always go the extra mile to take care of them. Unfortunately, natural disasters and other emergencies can take even the best owners by surprise. How can you keep your small business […]

Is Business Equipment Financing Right for Your Business?

Equipment financing is a popular option for obtaining the capital needed for business essentials. It offers many benefits for large corporations and small businesses alike. Is it the right choice for your company? Here are a few advantages that can help you decide: • Financing for businesses with poor credit • Flexibility for buying the […]